Market technique

Market technique is based on the old Dow Theory, first developed by Charles Henry Dow in the late 19th century. This theory is not only an important basic tool for market technique. Other technical analysis methods also make use of its teachings.

How is market technique different from chart technique?

Market technique is a technical analysis method. It forms the basis for chart technique. Chart technique works with price patterns and indicators and attempts to predict future developments based on past prices. Market technique, on the other hand, tries to empathise with individual market participants in order to forecast future prices. This means that no chart patterns or indicators are used. Trading decisions are made based on the bare chart. However, the chart patterns from the chart technique can be well explained by the market technique. For example, a shoulder-head-shoulder formation in market technique is nothing other than a trend reversal.

Market technique users always analyse a chart with two questions in mind:

Where does movement originate?

Who is buying after me?

There are distinctive points in the chart for this purpose where market participants are usually forced to take certain actions. A good example of a compulsion to act is the stop. Every market participant applies an initial stop somewhere to manage risk. This stop usually is at some high or low point. Once the stop price is reached, the order will become a market order and be executed in any case. This in turn may lead to severe movements on the markets.

Trading with market technique

Trading based on market technique is not about always being right. Basically, only the market is always right anyway. Future market developments can only be forecast with a certain probability. This applies accordingly to all other analysis methods. The goal is in developing a consistent trading style that produces duplicable profits. This statement implies that there are technically correct trades that nevertheless end up in the red. The This is called technically correct minus trades. There are, therefore, 4 types of trades:

-

technically correct plus trade

-

technically correct minus trade

-

technically incorrect plus trade

-

technically incorrect minus trade

How does market technique work?

Trading by market technique is a trend-following approach. The trend is the most important tool of a market technician accordingly. A separate chapter has covered what qualifies a trend, when trends are broken, and how they arise since this is very extensive.

Trader must try to put themselves in the shoes of other market participants since they can only achieve profits if any other market participants will enter the market in the same direction subsequently. In order to build a long position, a trader has to consider: Who is buying after me?

With a short position, they must ask: Who is selling after me?

Accordingly, it is important to know where they are located. Are they in an upwards or a downwards trend? Are they looking at movement or at correction?

Trends in market technique are described by the point count to answer all of these questions.

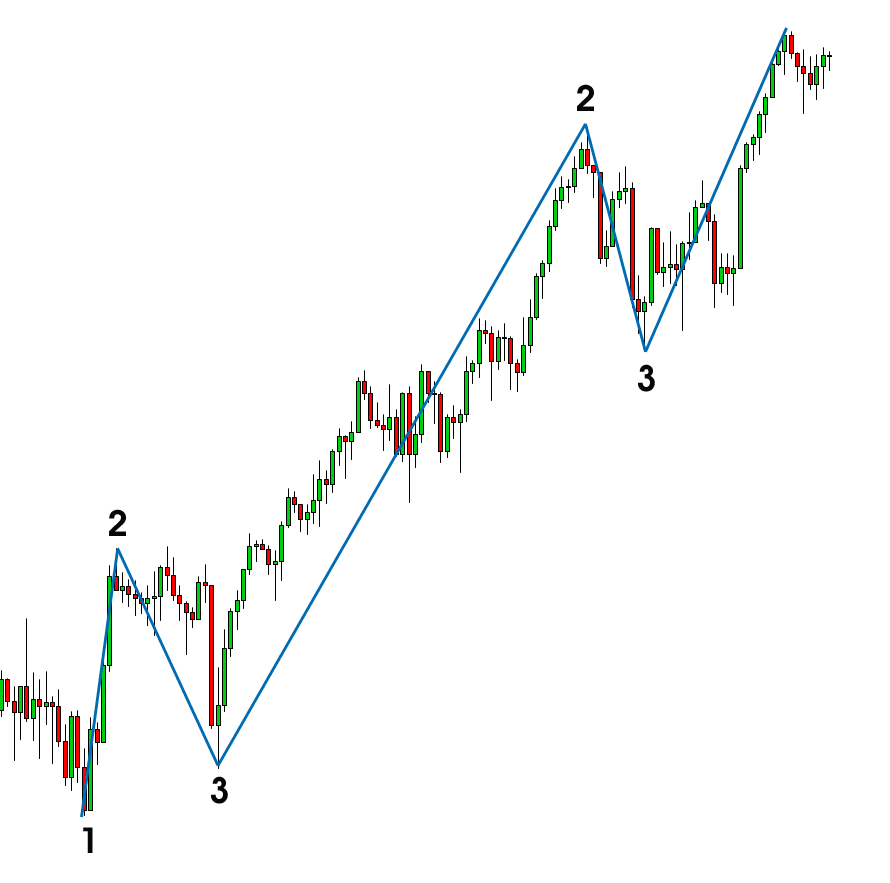

Point 1 is at the start of the first movement. It represents the first low point.

Point 2 is at the end of the first movement. It represents the first high point.

Point 3 is at the end of the first correction. It represents the second low that must be higher than the first.

… The count then starts again at point 2, the next high point, which is higher than the old point 2.

The first time you buy above point 2 will create a trend. In this case, it is an upward trend. The trend will continue for as long as it does not drop underneath the last point 3.

Trading successfully based on market technique

Market technicians usually combine two trend variables. The overriding trend variable (large-scale position) determines the direction, and the subordinate trend variable (signal position) determines the entry point.

Large scale position

The large scale position is also referred to as “where” since it is where localisation takes place. It answers the question of where one is located. Is it the movement or is it the correction? As a trend follower, one always tries to enter the market during a correction in order to maximise the risk/reward ratio. Accordingly, we will always wait for the correction in the “where”. Chart progressions that are too far along in the “where” will be dropped immediately. Only stocks that are undergoing correction will make it onto the personal watch list.

Signal position

The signal position is also called the “how”. This is about how best to enter the overriding trend. There are signs in the signalling situation when the overriding trend continues within a correction. This can be a subordinate 1-2-3 or a reversal bar, for example.

A good example of the combination of large-scale and signal positions can be found in the following chart:

Trading setups (entries) by market technique

Point 2 trade

P2 trading means waiting for a trend to emerge in the signal position that confirms the large-scale trend.

Entering in the correction

When entering from a correction, traders will wait until a trend has emerged in the signal situation that confirms the overriding trend. They will then wait until the resulting trend in the signal position corrects again.

Fuzzy

A fuzzy entry means that one is not waiting for a signal in the signal position. One thus enters the large scale position across the board when the correction is almost 100%.

We have put together a separate chapter on the setups since this is a highly complex subject.

Stops

Any professional trader has a loss limit stop when opening a position in the market since this makes the risk taken calculable. Traders who do not use stops will not produce profits in the long term. In addition to the initial stop, there are many other stop types and stop strategies that are required for trading. Due to this, we have also put together a detailed chapter on stop rules by market technique.