What is a trend?

Definition of trend

In terms of pricing on the stock exchange, a trend is an extraordinary development in the valuation of a security over time in a certain direction. It results from an initial movement in a corresponding direction, a subsequent correction in the opposite direction to this initial movement and the resumption of the original direction with the crossing above or below the first high or low point. There are three possible states in which a trend may occur. There is an upward trend, a downward trend, and a sideways phase, also referred to as a trendless phase.

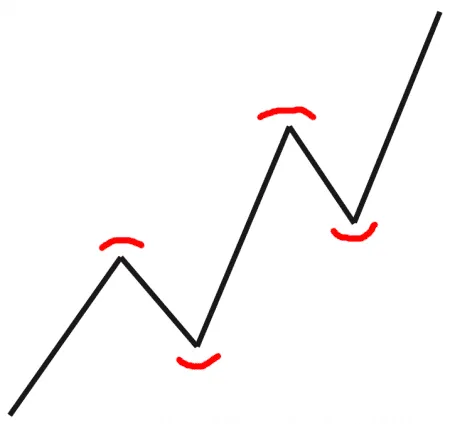

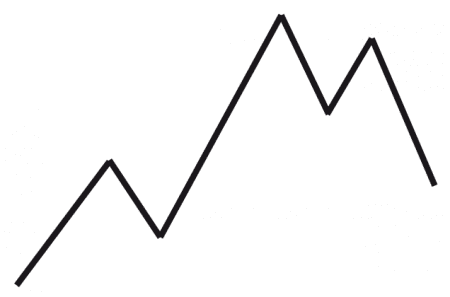

Upward trend

An upward trend is characterised by the fact that the subsequent highs are always higher than the previous high and the lows are also always higher than the previous lows. The extremes thus always are higher.

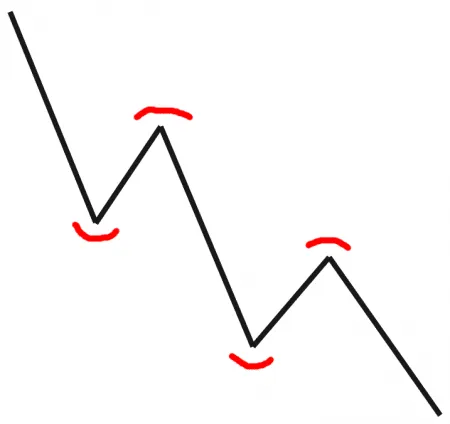

Downward trend

A downward trend is characterised by the fact that the lows are always lower than the previous low and the highs are always lower than the previous high. The extremes thus always are lower.

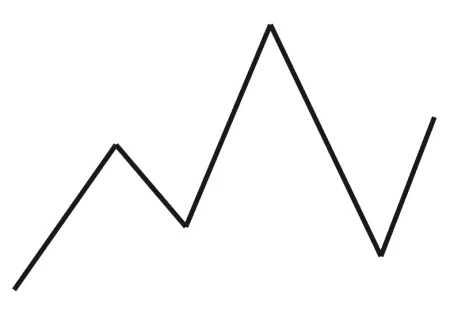

Sideways phase

The sideways phase is characterised by the fact that the conditions of the upward or downward trend are not fulfilled. This thus is a trendless phase.

Trend phases

The two trend phases of movement and correction are characterised by distinctive features. The more pronounced the characteristics are, the more significant the trend will be for retailers.

Movement

Movement typically takes place quickly and swiftly within a few candlesticks in the direction of the trend. This usually results in large candlesticks where the closing price within an upward trend closes at the upper end of the candlestick. In a downward trend, the closing prices are usually at the lower end. The candlestick pattern reflects considerably greater price pressure in the movement phase than in the correction phase. The volume usually increases during movement.

Correction

The correction is usually tough and slow. They run counter to the direction of the trend and can also establish themselves as a subordinate trend. In most cases, however, the corrections are very imprecise, so that trend breaks often occur within the subordinate trend. Corrections may correct up to 100 % of the previous movement without invalidating the current trend. The volume flattens out in the correction.

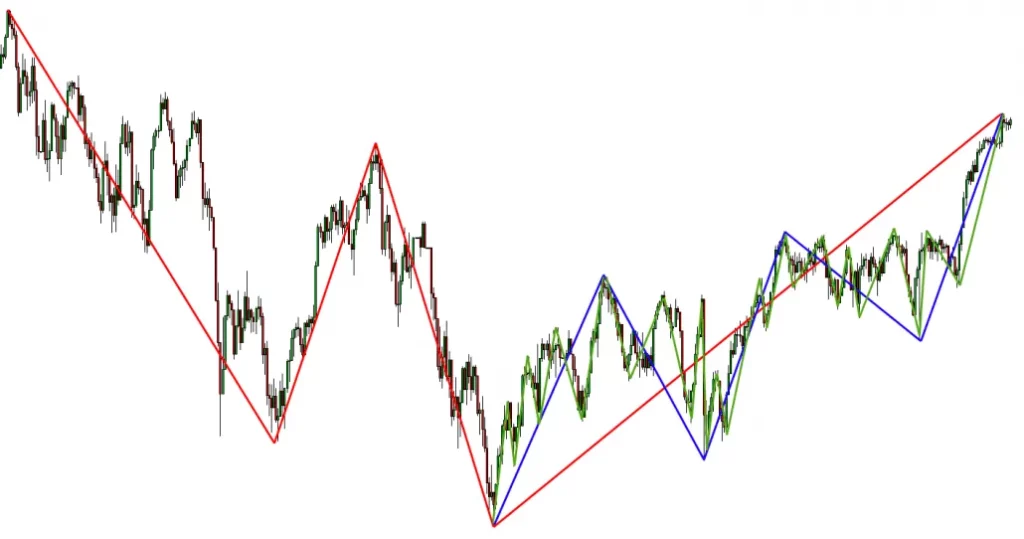

Trend values

The difficulty in trading is in recognising trends. Trends will happen at different trend sizes. Traders must recognise the current trend phase within a certain trend size. The following figure marks the different trend variables in colour. The red trend is the largest one, the blue trend the medium one, and the green trend the smallest one. However, it is possible that more than 3 trend sizes are evident within the same chart. There is no specific limit.

Thus, it is possible to see the different trend sizes in each chart. It makes sense to change the time unit of the chart display to see the smaller trend sizes better. This makes the subordinate trends more clearly visible. This also makes the difference between trend variables and time units clear. There is no connection between them. The choice of time units does not influence trend variables. The latter are present in every chart and can be seen more or less clearly, regardless of the selected time unit and zoom level.

Trend break

A trend break occurs when

-

the last low is undercut in an upward trend.

-

the last high is exceeded in a downward trend.

After a trend break, the market is trendless. Professional traders will now be waiting to see how the market develops and are usually flat until a new trend establishes itself. However, stop-fishing often occurs at such important points, resuming the former trend. Accordingly, a close look at the force that breaks the trend is required.

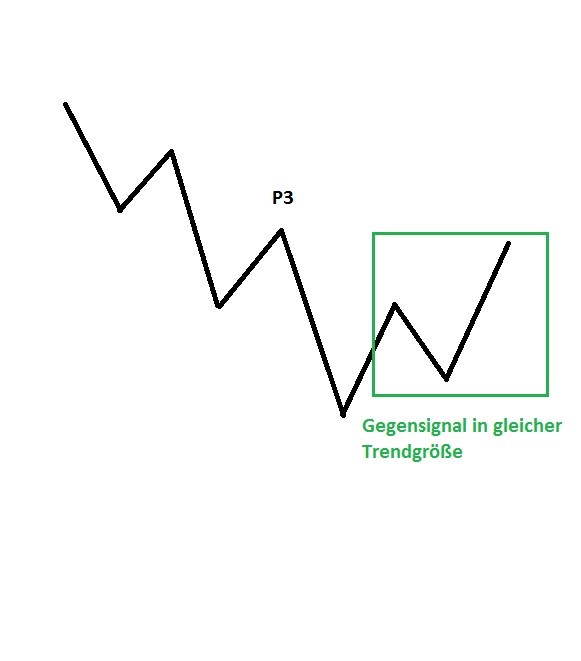

The trend break is not the only thing that may indicate that the trend is no longer intact. A counter-signal can also form on the same trend size and thus call the old trend into question. This is visualised in the following illustration.

The old upward trend is still intact. However, a downward trend of the same magnitude has formed in the other direction. Most market participants will now probably pay more attention to the new trend than the old one.

What is a counter signal?

A counter-trend signal is an opposing trend of the same trend size that breaks the existing trend without breaking through the last point 3. In the following example, the established downward trend is broken and replaced by a counter-signal in the form of an upward trend.

How do trends develop?

Trends are created by interaction of market participants. The cause of a trend may be in fundamental, political, or other reasons. The chart resulting in the end reflects the sum of all the actions of all market participants.

The initial movement of a security must be followed by a correction at some point, as the market participants who entered the market at the beginning of the movement have the idea of taking their profits. Increasingly few traders will be prepared to enter the security since the prices have already risen so far. This will lead to the correction phase where the initial movement is fully or partially countered. Increasing numbers of market participants will then be coming back into play, having missed the initial movement, and now seeing a favourable entry opportunity in the correction phase. This is the start of a new movement.

Many institutional investors have so much money that they can only buy into a stock bit by bit. If such investors are interested in buying a security, they will always enter the market during correction phases. This conduct is particularly evident in the chart when the volume increases in the direction of movement and rapid movements occur.